Underground Copper Mining Producer: Southern Peaks Mining (SPM) is advised by Global Natural Resource Investments (GNRI). GNRI works with management teams to invest in niche areas within global natural resources, particularly renewables, oil & gas, and mining & energy.

| LOCATION | Cañete, Lima, Peru |

| USUFRUCT AREA | 45,868 ha |

| TYPE OF DEPOSIT | IOCG |

| CASH COST (C1, 3-year avg) | US$2.25/lb |

| MINE TYPE | Underground |

| KEY COMMODITIES | Cu (with Au/Ag by-products) |

| PLANT CAPACITY | 8,400 tpd |

| OWNERSHIP | 99.1% |

| LOCATION | Cañete, Lima, Peru |

| USUFRUCT AREA | 45,868 ha |

| TYPE OF DEPOSIT | IOCG |

| CASH COST (C1, 3-year avg) | US$2.25/lb |

| MINE TYPE | Underground |

| KEY COMMODITIES | Cu (with Au/Ag by-products) |

| PLANT CAPACITY | 8,400 tpd |

| OWNERSHIP | 99.1% |

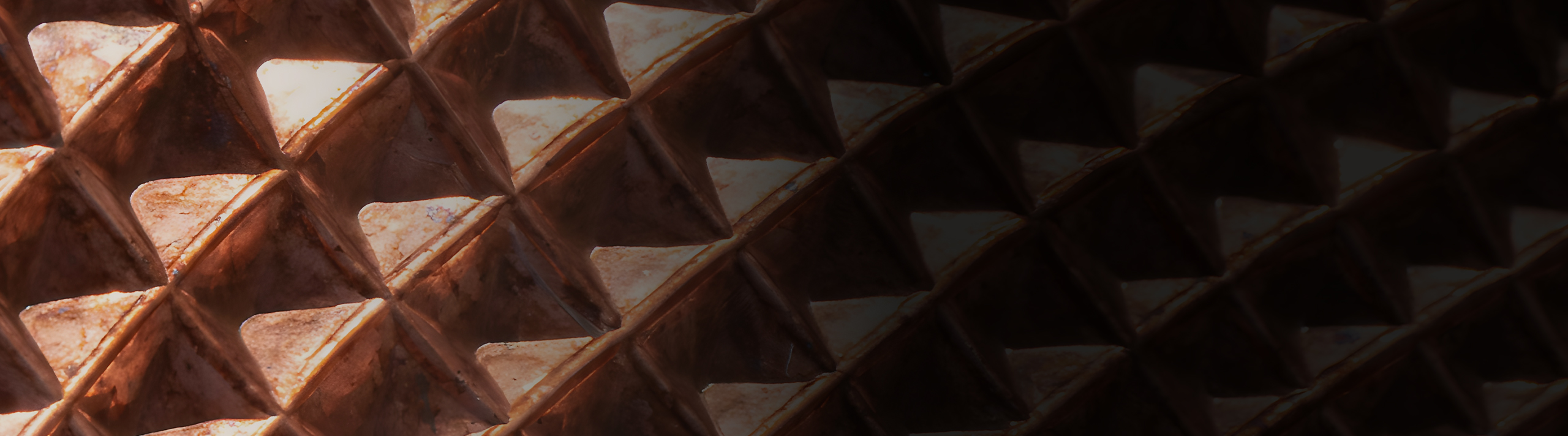

Compañía Minera Condestable (CMC) is a leading underground copper producer in Peru with a strong track record. We operate an iron oxide-copper-gold (IOCG) deposit with two contiguous mines – Condestable and Raúl – strategically located in the province of Cañete, just 3 km from the Pan-American Highway and about 100 km from the port of Callao. Our land package covers over 45,000 hectares

Our current operation has a processing capacity of 8,400 tonnes per day (tpd), producing about 23,000 tonnes of copper equivalent concentrate annually, with gold and silver by-products. An NI 43-101 Feasibility Study supports a planned expansion to 10,000 tpd, with the environmental permit for the expanded capacity expected in H1 2026. Our strong track record of replacing and expanding reserves and resources will sustain future growth.

Commitment to Sustainability and Innovation

At CMC, sustainability is a fundamental pillar. We are the first medium-sized underground mining operation in the world to obtain the Copper Mark certification, which attests to our sustainable copper production. In addition, we were the first operation to obtain a renewable energy certificate for using 100% renewable power in our activities.

A Legacy of Growth and Transformation

With a history dating back to the 1960s, CMC has experienced continuous growth and transformation. After a period of government ownership and a privatization in 1992, Trafigura acquired a stake in 1997 and significantly expanded the plant’s capacity from 1,500 tpd to 7,000 tpd while integrating the Raúl mine. In 2013, Southern Peaks Mining (SPM) acquired CMC and continued expanding the operation, reaching the current plant capacity of 8,400 tpd by 2021.

Leading Electromobility in Underground Mining

At Compañía Minera Condestable, we are at the forefront of innovation and sustainable mining. We focus on implementing advanced technologies and best practices to minimize our environmental impact and optimize our operations.

We are pioneers in Peru as the first underground mine to have a fleet of electric vehicles. We have incorporated an electric Telehandler, a 35-ton BYD electric truck, a Volvo electric front loader, and JMC and Voltera electric trucks. The electric truck and trucks operate inside the mine. This initiative is part of our ambitious energy transition program, which seeks to reduce our carbon footprint and optimize energy use.

Advanced Tailings Management

We are committed to the responsible management of our tailings, adapting to the Global Tailings Management Standard (GISTM). We are currently implementing a tailings filtration plant that will allow us to increase water recovery from 60% to 95% and move to dry stack tailings, best in class technology in the industry.

In addition, we are in a continuous process of evaluating and updating the designs of our existing tailings dams to ensure compliance with international CDA and ICMM standards. Going forward, we have engineered a new filtered tailings impoundment with a total projected life of over 40 years.